Background:: At present, China's million dollar assets ranked third in the world. However, due to the current majority of domestic financial institutions, such as banks, funds and other policy restrictions, cannot be mixed business, so they provide customers with financial services, many can only be limited to its own products. And financial advisors as a third party financial institutions can provide investment planning, risk management planning, tax planning, cash planning, consumer spending planning, pension planning and property distribution and heritage planning.

At present, the number of domestic private bank customers close to 150,000, and asset management should be more than 5 trillion yuan.

From the open account, the independent wealth management services company or occupy the entire wealth management services industry, about 7% of the market share, and from the number of customers, its market share of about 8%.

Challenges: New potential customers cannot be transferred to the sales department for the first time

Business people do not have enough professional knowledge to provide customers with timely and accurate service

Sales staff need to spend a lot of time to repeat the record activities, write a report

New sales staff cannot quickly understand the company's existing sales theory

The information or tools needed for sales are scattered everywhere

Management has no way to control the business situation of the entire company through real-time reporting

No unified management platform, more branches in the customer information management, sales management and product management work cannot be timely coordination

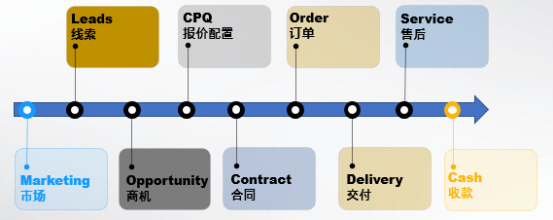

• Build a unified sales process, improve sales efficiency and efficiency From the potential customers to cultivate, and gradually tap the needs of customers, customers sign, customer product redemption, buy again to form a virtuous circle, improve sales efficiency.

• Use salesforce to build configurable KYC work drafts and risk assessment test models Based on salesforce, you can build flexible KYC working papers and risk assessment models, and regularly understand your customer's investment preferences and risk tolerance.

• Use WeChat to complete the daily work records and roadshow customer invitation. Topen up the salesforce and WeChat business account between the communication platform, making the financial planner through the WeChat simple and quick to understand how many visits need to be completed today, and to complete daily visits and customer entry work directly in the WeChat, without any platform limits. At the same time through the WeChat service number, financial planner can be directly to the road show information sent to the circle of friends, customers can directly through the WeChat activities for registration.

• Real-Time Analysis Based on the data within the system, management, sales executives can be implemented to see the amount of product signing, the number of activities, the completion of the company's performance. Financial planner can see their own performance in real time to complete the situation and performance ranking.

• Real-Time Analysis Based on the data within the system, management, sales executives can be implemented to see the amount of product signing, the number of activities, the completion of the company's performance. Financial planner can see their own performance in real time to complete the situation and performance ranking.

• Build a unified sales process, improve sales efficiency and efficiency From the potential customers to cultivate, and gradually tap the needs of customers, customers sign, customer product redemption, buy again to form a virtuous circle, improve sales efficiency.

• Use salesforce to build configurable KYC work drafts and risk assessment test models Based on salesforce, you can build flexible KYC working papers and risk assessment models, and regularly understand your customer's investment preferences and risk tolerance.